Bond Futures

28 An example of treasury bond futures Suppose that the cheapest-to-delivery bond of a Treasury bond futures contract is known to be 12% coupon bond with a conversion factor of 1.4000. The coupons are paid semiannually on the bond. The last coupon payment was 60 days ago. The conversion factor system (CFS) is used in the determination of the invoice price of the Chicago Board of Trade Treasury-bond futures. As an alternative to the CFS, Oviedo Oviedo, R.A., 2006. Calculating Bond Conversion Factors. Use conversion factors to normalize the price of a particular bond for delivery in a futures contract. When using conversion factors, the assumption is that a bond for delivery has a 6% coupon. Use convfactor to calculate conversion factors for all bond futures from the U.S., Germany, Japan, and U.K.

Bond futures are futures contracts where the commodity for deliveryis a government bond. There are established global markets for governmentbond futures. Bond futures provide a liquid alternative for managinginterest-rate risk.

In the U.S. market, the Chicago Mercantile Exchange (CME) offersfutures on Treasury bonds and notes with maturities of 2, 5, 10, and30 years. Typically, the following bond future contracts from theCME have maturities of 3, 6, 9, and 12 months:

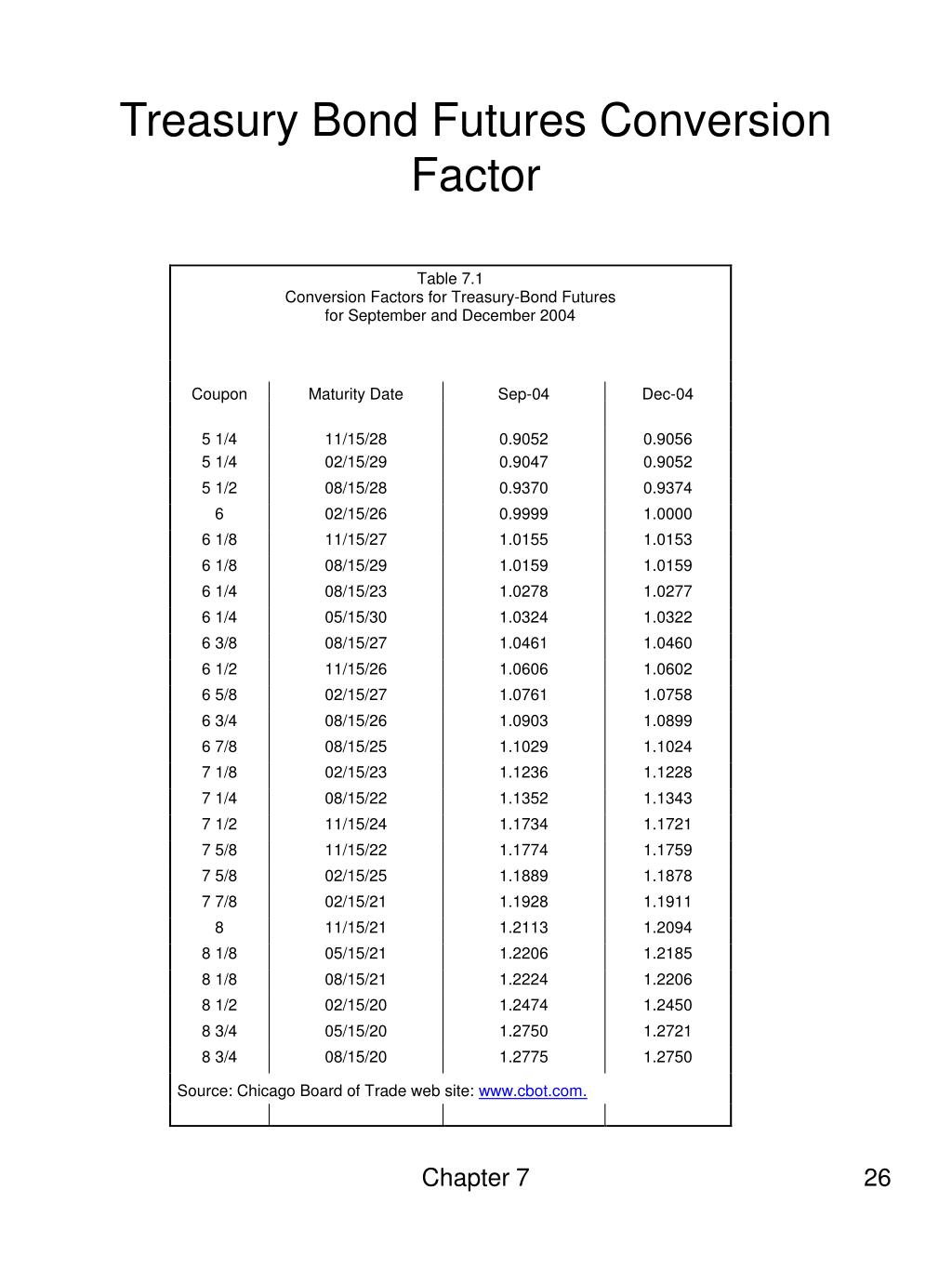

The short position in a Treasury bond or note future contractmust deliver to the long position in one of many possible existingTreasury bonds. For example, in a 30-year Treasury bond future, theshort position must deliver a Treasury bond with at least 15 yearsto maturity. Because these bonds have different values, the bond futurecontract is standardized by computing a conversion factor. The conversionfactor normalizes the price of a bond to a theoretical bond with acoupon of 6%. The price of a bond future contract is represented as:

where:

FutPrice is the price of the bond future.

CF is the conversion factor for a bond todeliver in a futures contract.

AI is the accrued interest.

The short position in a futures contract has the option of whichbond to deliver and, in the U.S. bond market, when in the deliverymonth to deliver the bond. The short position typically chooses todeliver the bond known as the Cheapest to Deliver (CTD). The CTD bondmost often delivers on the last delivery day of the month.

Financial Instruments Toolbox™ software supports the followingbond futures:

Conversion Factor Bond

U.S. Treasury bonds and notes

German Bobl, Bund, Buxl, and Schatz

UK gilts

Japanese government bonds (JGBs)

The functions supporting all bond futures are:

Function | Purpose |

|---|---|

Calculates bond conversion factors for U.S. Treasurybonds, German Bobl, Bund, Buxl, and Schatz, U.K. gilts, and JGBs. | |

Prices bond future given repo rates. | |

Calculates implied repo rates for a bond future givenprice. |

Conversion Calculator

The functions supporting U.S. Treasury bond futures are:

Function | Purpose |

|---|---|

Calculates future prices of Treasury bonds given thespot price. | |

Calculates future prices of Treasury bonds given currentyield. | |

Calculates implied repo rates for the Treasury bond futuregiven price. | |

Calculates Treasury bond futures price given the impliedrepo rates. | |

Calculates Treasury bond futures yield given the impliedrepo rates. |

See Also

bnddurp | bnddury | bndfutimprepo | bndfutprice | convfactor | tfutbyprice | tfutbyyield | tfutimprepo | tfutpricebyrepo | tfutyieldbyrepo

Related Examples

More About

Financial acronyms

The entire acronym collection of this site is now also available offline with this new app for iPhone and iPad.

Conversion Factor Definition

Description

Formula for the calculation of a bond's basis.

Formula

Legend

| (CF_{bond} ) | Conversion factor |

| (clnPrice_{bond} ) | Bond clean price |

| (rtPrice_{Fut} ) | Market price of the futures contract |

Additional information related to this formula

Related definitions:

• • • •